How does the stock market perform during an election year? Does it matter which party wins the Presidency? See what the data says.

How Fast The World Can Change

On February 12, the Dow Jones Industrial Average closed at an all-time high of 29,551. At that time, the economy was humming, corporate earnings were rising and unemployment was at lows last seen during the mid-1950s. While global health experts were increasingly worried about a potential pandemic caused by a new Coronavirus, it seemed to be something that was off in the distance. SARS, MERS, and the 2009 Swine Flu pandemic had all run their respective course without derailing the global economy. The hope was that COVID-19 would as well.

Needless to say, things didn’t exactly pan out that way. In mid-February, health officials sounded the alarm that COVID-19 was coming to virtually every corner of the globe and would be difficult, if not impossible, to contain. Models from medical institutes were generated showing grim infection and mortality rates. Governments around the world responded by implementing extreme measures to combat the pandemic, shuttering all but essential businesses, canceling public gatherings of most any size, and ordering people to shelter in place for an extended, and undetermined, amount of time.

The combination of events effectively turned both corporate and consumer spending – the twin engines of global economic growth – to a trickle. This unavoidable and unexpected reality sent stocks into a tailspin so rapid that there was no historical precedent, even during the Great Depression. When the Dow reached its (thus-far) low of 18,591 on March 23, it represented the shortest period of time ever in which that index declined 30% or more from its peak.

Economists refer to developments such as the COVID-19 pandemic as “exogenous events” – unexpected and highly impactful events that are so far outside the bounds of normal expectations that they can’t be modeled. After a twenty-year time period in which we’ve seen 9/11, the Great Recession, and the current pandemic, we feel we speak for most people when we say we’re getting a little tired of exogenous events.

As individuals, we are all grappling with the anxieties and uncertainties that the COVID-19 pandemic has ushered into our lives. On a purely investment level, however, we would like to share some of our thoughts that we hope will provide some perspective during this time of uncertainty.

* * * * *

When the Dow fell to about the 20,000 level on March 17, the stock market at that point was pricing in an expectation of a 50% to 80% decline in corporate profits from the economic fallout associated with the pandemic (source: Brian Wesbury, Chief Economist, First Trust). By comparison, corporate profits fell 46% in 2008, a time when the global financial system was on the brink of collapse. Being forward-looking, the stock market has already priced in a drop in corporate profits as bad or worse than anything we saw in 2008. So, while the market may well decline below its recent lows, it is hard to argue that it hasn’t already factored in a major economic downturn.

Should that dire scenario fail to materialize, we would expect a rapid rebound in stocks as the market quickly reprices itself for expectations of higher corporate profits. That repricing may (or may not) already be underway in light of the significant gains stocks have posted since the Dow reached its recent low on March 23. Since that point, the Dow has seen two historically large moves upward, and a lot of volatility in between. The first big move was on March 24, when the Dow gained more than 11%, the largest one-day percentage gain for that index since 1933. The Dow continued upward for the next two trading sessions, at the end of which it had soared more than 21% in just three days. If you’re keeping score at home, that effectively ended the official bear market that had begun on March 11, when the Dow closed 20% below its February 12 record high. It may be semantics when we look back on this down the road, but it was the shortest bear market in history. Stocks then bounced around in late March and early April before another big move upward April 6-8, when the Dow gained 11.23%.

* * * * *

The pundits love to dismiss these sudden upward moves in the stock market as “fake bounces.” They say they are but mirages, temporary upward climbs on a long, painful slog downward. They may well be right; only time will tell. But one thing we know for certain is that they don’t know anything more than you or us about whether the market truly hit bottom on March 23 or whether there is more in the downturn yet to come.

“Fake” bounces are indeed common occurrences during times of extreme market volatility. We saw many of them during the Great Recession in 2008-09. But the thing is, sooner or later that bounce will turn out to have been real, and we will only know it with the benefit of hindsight. A great example of this was when the Dow bottomed out at 6,469 on Friday, March 6, 2009. You may recall that, at that time, there was no good news to be had. The foundation of the global financial system was still quaking, unemployment was soaring, and stock investing was derided as a fool’s errand.

The conventional wisdom of the day was that we should not expect a v-shaped recovery in stocks, but more of a u-shaped one in which we slogged along at the bottom for months or years. An unnerving headline in The Wall Street Journal the next Monday read: “Dow 5000? There’s a Case for It.” Let the record show that this was the exact date the bear market ended and stocks took off; a decade later the Dow was at 25,650.

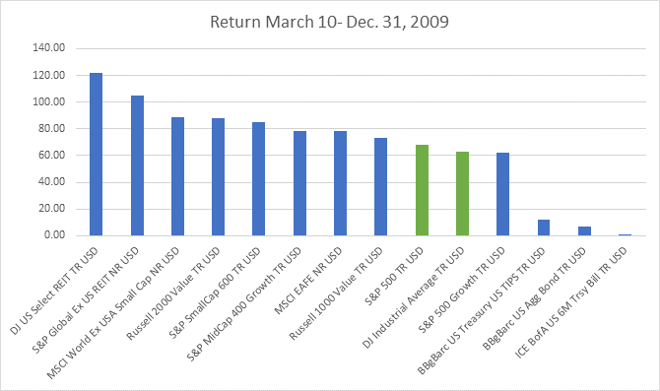

When the market does reach its bottom and the current downturn ends, investors on the sidelines who have been awaiting the all-clear signal will be in for a rude awakening. Stocks do not send out announcements when they change course, and the news environment is often deeply negative when they do. For example, when stocks began their turnaround in March 2009, they did so with breathtaking speed. Here is a graph showing the cumulative gains logged by a variety of market benchmarks from March 10, 2009, to December 31, 2009 (remember that these are indexes, not actual investment products; past performance is not an indication of future results):

In a span of less than nine months, stocks across all sectors posted gains that often take a decade or more to achieve. The pundits were there every step of the way to warn us that this was yet another fake bounce. But it wasn’t, and investors who heeded the bad advice missed out on crucial gains that those who stayed invested enjoyed.

* * * * *

We are all feeling a lot of empathy these days for the economic pain that the shutdown is inflicting on millions of people. When we dare to venture out of our homes to make a dash into a grocery store or pharmacy, we all see the same thing: mile after mile of businesses shuttered and parking lots emptied. We ache for the owners of the businesses in our own neighborhoods, many of whom we know and care about, and wonder if they will be able to survive. It’s tempting to extrapolate what we see with our own eyes to the larger investment picture. With so many businesses – even publicly-traded ones – likely to fail, how can we have confidence in investing in stocks?

This is where it’s important to remember that our investment philosophy at CAM Investor Solutions is grounded in the belief that we should invest in markets, not individual companies. We construct our portfolios so that every client has broad exposure to thousands of companies. Inevitably there will be winners and losers in the months and years ahead. As we saw in 2000-02 and again in 2008-09, there will be high profile, household-name companies that fail. But there will also be winners that come out of the aftermath, companies that are well-positioned and able to pivot to take advantage of the new economic environment. New companies will come out of nowhere and bring vital new products and services to the world and thrive because of it.

In the long run, stock returns are a reflection of the future expected earnings and the cost of capital for public companies. When we employ a broadly diversified portfolio strategy, we are effectively letting the free market sort out the winners and losers while we capture the long-term benefits of stock investing.

* * * * *

We are not typically fans of Jim Cramer’s shock-jock approach to stock investing on his CNBC show, but he did raise a point recently that resonated with us.

“If you’re short (i.e., betting against the market), you’re betting against science,” he said on March 27. His point was that scientific innovation is an incredible tool for solving seemingly insurmountable problems, and assuming the current Coronavirus pandemic will go on without any solution to it is, well, a rather dim view of human ingenuity.

With that, we wholeheartedly agree. And the point is valid well beyond the realm of science. Consider that, for the first time in human history, the world is collectively focused on solving a single problem. Right now, there are 7.5 billion people on this planet who are all anxious to see an end to this pandemic as soon as possible. Scientists, engineers, executives, entrepreneurs, politicians – everyone wants an answer to the Coronavirus crisis.

This unified desire has provoked an unimaginable deployment of the world’s resources to the crisis. In just the span of a few weeks, we have seen the following response to a virus that has only been known since late December:

Over 52 potential vaccines submitted for review to the FDA and other global health organizations.

Testing kits are being produced in the millions to detect both current infections and prior exposure to the Coronavirus. This will provide vital knowledge to understanding how widespread the virus is and when the world can get back to work.

Assembly lines at Ford and General Motors converted to manufacturing ventilators.

Cruise ships converted to hospital ships.

Breweries converting their fermentation tanks to make hand sanitizer.

Apparel companies converting their production lines to manufacture masks, face shields, and gloves for healthcare workers on the front lines.

Corporate jets being used to transport critical supplies to the most affected areas at no charge.

We could go on and on, but the point is clear. Human ingenuity is a vast and incalculable resource and it is being put to use on a single problem like never before. In times of crisis, it can be difficult for investors to put their faith into solutions that haven’t emerged yet. But we can look back over the course of history and see that human ingenuity has seen us through every crisis we have ever faced. We are confident it will see us through this crisis as well.

* * * * *

As wealth advisors, we are – first and foremost – in the relationship business. Building trust and rapport with our clients is vital to helping us understand their needs and achieve their goals. It’s something that happens organically over time; along the way, we get to know our clients and our clients get to know us.

All of which is to say, our relationship with each of you means a lot to all of us at CAM Investor Solutions. Financial events – market declines, recessions, etc. – can be difficult times for investors. But a pandemic brings a different type of anxiety altogether. All of us worry about how the people we know and care for will be affected by this, both from a health perspective and an economic perspective.

If there is any silver lining in all of this, it’s that this crisis has honed all of our priorities and deepened our appreciation for the people we care about. Please know that we are here for you in this trying time, both as advisors and as friends. If you want to discuss your financial situation, of course, we are always available for that. But if you just want to vent, be reassured, or just generally have some human connection while we are all feeling housebound and isolated, please pick up the phone (or send us a Zoom meeting invitation!) and we will be there for you. And if there is anything we can do to assist you or a loved one who is in need, please know that we will be happy to help in any way we can.

Best,

CAM Investor Solutions

Source: Index data from Bloomberg, Dimensional Fund Advisors, and Capital Directions; M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC-registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding the fairness of any transaction. It does not constitute an offer, solicitation, or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.